The global pandemic Covid-19 has not only caused massive impacts to our world economy and daily living, it has also started to change our workflow and format, as we change and adapt with this crisis and situation, adopt working from home (WFH) as a new normal. While the future new normal working has yet to be fully defined, we are definitely moving towards a new normal, online banking is one of the accelerated shift towards this segment. However, there are are data security concerns with rise of online banking by Singaporeans.

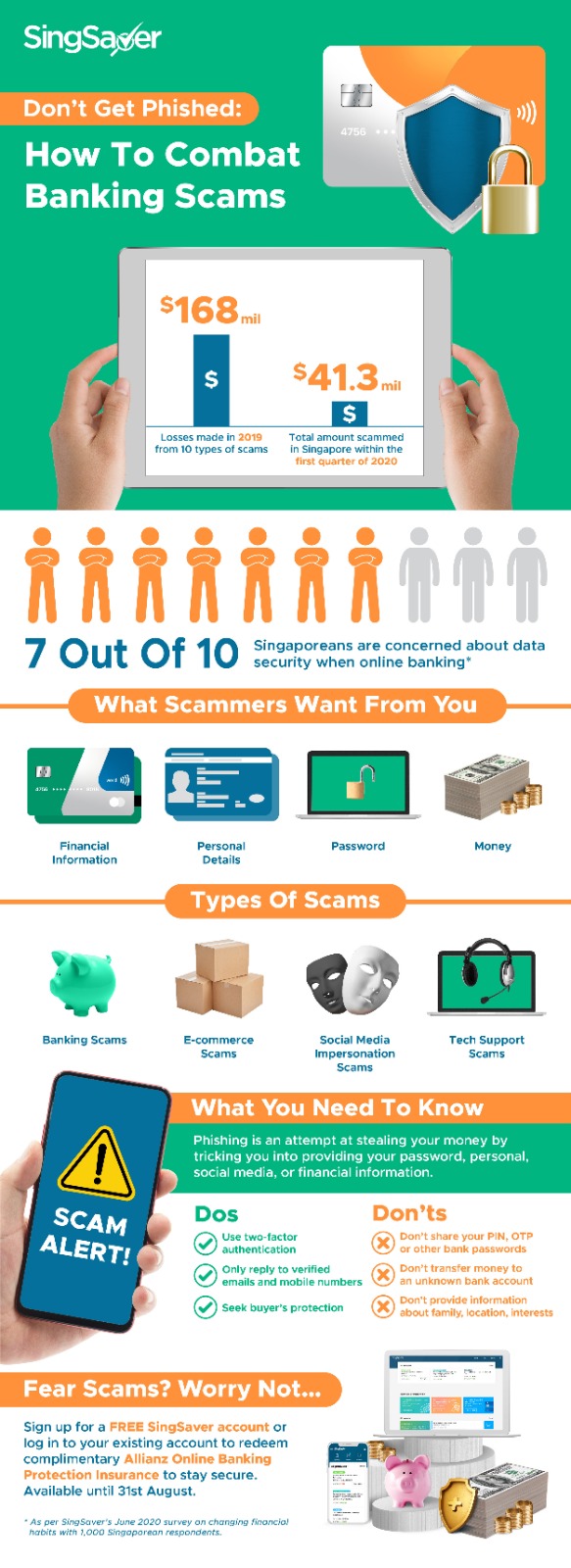

SingSaver conducted a survey in June, analysing 1,000 responses detailing the changing financial habits of Singaporeans during this global pandemic. They found a majority (72%) of respondents agree or strongly agree that they are concerned about online data security due to increased online banking.

In lieu of this data security concern by Singaporeans with rise of online banking, SingSaver has partnered with Allianz Insurance Singapore to provide free Online Banking Protection Insurance for three months for all new and existing SingSaver account holders, offering protection from fraudulent cyber activity that results in financial loss.

The free three month insurance covers incidences such as:

- Unauthorised access to or use of credit card, debit card or bank account issued by a financial institution in Singapore in electronic device(s)

- Transmission or introduction of computer virus or harmful code into electronic device(s)

- Alteration, corruption, damage, manipulation, misappropriation, theft, deletion or destruction of one’s electronic device(s); or

- Inhibition or restriction of access targeted at or directed against one’s electronic device(s)

The plan reimburses consumers up to SGD1,000 per event or SGD2,000 per insured individual for such cyber attack incidents.

“While we’ve done a great job providing consumers with resources and tools to make more informed financial decisions, in today’s volatile financial landscape, we want to address the growing need for cyber protection. Besides educating consumers on preventive measures, it is also important to acknowledge the consequences of such attacks and how we can mitigate it through protection,” said Prashant Aggarwal, Chief Commercial Officer, CompareAsiaGroup and Interim Country Manager, Singsaver.

Singaporeans, Permanent Residents and long-term pass holders aged 18 and older are eligible for the free Allianz Online Banking Protection Insurance, as long as they possess a NRIC or FIN and an activated SingSaver account when a claim is made.

For more information, please visit SingSaver website. If you like to know more about their free Online Banking Protection Insurance, please visit this page on SingSaver website. Do read their Terms and Conditions and Frequently Asked Questions on the page too.

* Information and picture courtesy of SingSaver and Mutant Communications *